proposed estate tax changes september 2021

Currently the estate-tax exemption is set to expire and roll back after 2025 but the proposal released Monday would reduce the exemption back to 5 million at the end of 2021. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

That is only four years away and Congress could still.

. Importantly the House could still amend this legislation and the Senate is actively working on its own bill. However the plan does not include. The sunset of the increased exemptions from federal estate gift and generation-skipping transfer GST tax currently at 117 million per individual could accelerate from December 31 2025 to December 31 2021 leaving individuals with approximately 6 million in exemptions after inflation adjustments.

September 20 2021. Proposed tax law changes in the draft legislation that could affect clients estate planning include. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022.

Concerned taxpayers and their advisors should pay attention to these potential developments as they may affect their present. The Democrats of the House of Representatives have released a much-anticipated tax plan that would significantly impact the federal estate and gift tax system. Estate and Gift Tax Exemption Decreases Lower the gift tax and estate tax exemption from the current 117 million per person 234 million per married couple to the 2010 level of 5 million per person adjusted for inflation.

July 13 2021. Individuals and married couples who expect to have assets at death in excess of the reduced federal estate tax exemption that would be available to them if the proposed tax changes were adopted 35 million per individual and who have not already fully used their federal giftestate and GST exemptions may wish to act now to take advantage of the existing. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

This amount could increase some in 2022 due to adjustments for inflation. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. Final regulations establishing a user fee for estate tax closing letters.

The current 2021 gift and estate tax exemption is 117 million for each US. Final regulations under 1014f and 6035 regarding basis consistency between estate and person acquiring property from decedent. In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives.

The House proposal accelerates the 2026 reduction to 2022 and. Under current law it is possible to create. The Biden Administration has proposed significant changes to the income tax system.

The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published. Increase in Capital Gains Taxes effective as of September 13 2021. If this proposal were to become law the potential drop in the exemption might be a reason to consider completing large gifts before year-end.

As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan. November 03 2021. In September the House Ways and Means Committee released an extensive tax package that would have resulted in enormous changes for estate tax planning.

Nevertheless the time for estate planning is now. The Sanders proposal had provided for a 1 million gift tax exemption and a 35 million exemption for estate and GST tax purposes. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022.

Changes to the grantor trust rules. The 2021 exemption is 117M and half of that would be 585M. By David B.

As of this writing on September 22 2021 no bill has been enacted. Following weeks of negotiations between President Joe Biden and congressional Democrats the White House released a retooled framework for the Build Back Better Act on October 28. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to worry about having to pay the federal estate tax.

The package proposed reducing the current. Proposed and temporary regulations were published on March 4 2016. Proposed regulations were published on December 31 2020.

The effective date for this increase would be September 13 2021 but an exception would exist for gain recognized resulting from sales under binding contracts entered into prior to the effective date. As many people are aware Congress is considering changes to the federal tax code to support President Bidens Build Back Better spending plan. The proposal includes an increase in the highest capital gains tax rate from 20 to 25.

The effective date for this increase would be September 13 2021 but an exception would exist for gain recognized. However the revised proposals have eliminated this early sunset so if enacted the higher exemption would remain available through. On September 13th the House Ways Means Committee released draft legislation that included reverting the estate tax exemption to pre-TCJA levels in January 2022.

As of this writing on September 22 2021 no bill. The For the 995 Percent Act. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. You can use these in-depth slides to follow along with Bob Keeblers podcast The use it or lose it situation with the estate tax exemption. The proposed bill seeks to increase the 20 tax rate on capital gains to 25.

Would reduce the estate tax exemption to 35 million from 117 million in 2021 and increase the progressivity of the estate tax with rates from 45 percent to 65 percent among other changes. This Alert focuses on the changes that directly impact common estate planning strategies. 2021 Proposed Tax Reform.

With inflation this may land somewhere around 6 million.

406 Startup Failure Post Mortems

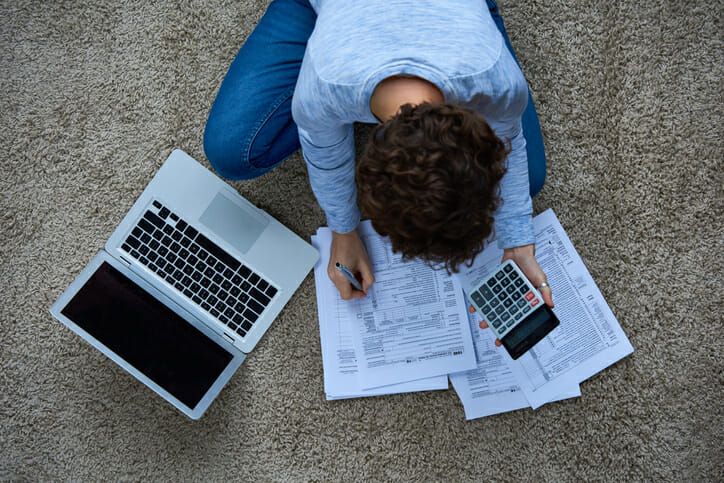

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Sales Tax Holidays Politically Expedient But Poor Tax Policy

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

/GettyImages-450769919-93fd4c5f134949e6a5573fb8856a2ac5.jpg)

How The Tcja Tax Law Affects Your Personal Finances

Lab Grown Meat Is Supposed To Be Inevitable The Science Tells A Different Story

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Time To Change Your Estate Plan Again

What S In Biden S Capital Gains Tax Plan Smartasset

Tax Brackets For 2021 2022 Federal Income Tax Rates

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

What The Bleep Is Going On With Texas Property Taxes Texas Monthly